小編過往寫了不少大跌後抄底的選股策略,這陣子就來跟大家再整理一次。

在分享這些策略之前,先跟大家介紹一個指標。

以前市場老師父常說,新手套在頭部,老手套在半山腰,所以我們得先分清楚目前是反彈還是回昇。

所有抄底的策略輸錢的交易,最常見的就是在大盤還沒見底時就出現的抄底訊號,以及進場後來不及停利而最終必須停損出場的交易。

這個指標先前也跟大家介紹過,就是拿權值股前100檔去計算目前有多少檔站在月線之上。

這個指標的腳本如下,大家可以複制到腳本編輯器裡,不用自己一檔一檔敲。

setbackbar(200);

settotalbar(1000);

array:T50[100](0);

t50[1]=GetSymbolField("5876.tw","close");

t50[2]=GetSymbolField("2317.tw","close");

t50[3]=GetSymbolField("2412.tw","close");

t50[4]=GetSymbolField("1301.tw","close");

t50[5]=GetSymbolField("1303.tw","close");

t50[6]=GetSymbolField("2454.tw","close");

t50[7]=GetSymbolField("1326.tw","close");

t50[8]=GetSymbolField("2308.tw","close");

t50[9]=GetSymbolField("2882.tw","close");

t50[10]=GetSymbolField("2881.tw","close");

t50[11]=GetSymbolField("2891.tw","close");

t50[12]=GetSymbolField("2002.tw","close");

t50[13]=GetSymbolField("1216.tw","close");

t50[14]=GetSymbolField("3008.tw","close");

t50[15]=GetSymbolField("2886.tw","close");

t50[16]=GetSymbolField("3711.tw","close");

t50[17]=GetSymbolField("2357.tw","close");

t50[18]=GetSymbolField("2474.tw","close");

t50[19]=GetSymbolField("3045.tw","close");

t50[20]=GetSymbolField("6505.tw","close");

t50[21]=GetSymbolField("2303.tw","close");

t50[22]=GetSymbolField("2382.tw","close");

t50[23]=GetSymbolField("2207.tw","close");

t50[24]=GetSymbolField("2892.tw","close");

t50[25]=GetSymbolField("4938.tw","close");

t50[26]=GetSymbolField("2884.tw","close");

t50[27]=GetSymbolField("2912.tw","close");

t50[28]=GetSymbolField("2885.tw","close");

t50[29]=GetSymbolField("2883.tw","close");

t50[30]=GetSymbolField("2105.tw","close");

t50[31]=GetSymbolField("2880.tw","close");

t50[32]=GetSymbolField("2330.tw","close");

t50[33]=GetSymbolField("4904.tw","close");

t50[34]=GetSymbolField("5880.tw","close");

t50[35]=GetSymbolField("2823.tw","close");

t50[36]=GetSymbolField("9904.tw","close");

t50[37]=GetSymbolField("1402.tw","close");

t50[38]=GetSymbolField("1101.tw","close");

t50[39]=GetSymbolField("2887.tw","close");

t50[40]=GetSymbolField("2890.tw","close");

t50[41]=GetSymbolField("2801.tw","close");

t50[42]=GetSymbolField("2633.tw","close");

t50[43]=GetSymbolField("5871.tw","close");

t50[44]=GetSymbolField("2301.tw","close");

t50[45]=GetSymbolField("2395.tw","close");

t50[46]=GetSymbolField("2354.tw","close");

t50[47]=GetSymbolField("9904.tw","close");

t50[48]=GetSymbolField("1102.tw","close");

t50[49]=GetSymbolField("2408.tw","close");

t50[50]=GetSymbolField("2227.tw","close");

t50[51]=GetSymbolField("2409.tw","close");

t50[52]=GetSymbolField("6669.tw","close");

t50[53]=GetSymbolField("2377.tw","close");

t50[54]=GetSymbolField("2888.tw","close");

t50[55]=GetSymbolField("4958.tw","close");

t50[56]=GetSymbolField("3037.tw","close");

t50[57]=GetSymbolField("2301.tw","close");

t50[58]=GetSymbolField("9921.tw","close");

t50[59]=GetSymbolField("2049.tw","close");

t50[60]=GetSymbolField("5269.tw","close");

t50[61]=GetSymbolField("1476.tw","close");

t50[62]=GetSymbolField("3481.tw","close");

t50[63]=GetSymbolField("8464.tw","close");

t50[64]=GetSymbolField("8454.tw","close");

t50[65]=GetSymbolField("2823.tw","close");

t50[66]=GetSymbolField("2603.tw","close");

t50[67]=GetSymbolField("3231.tw","close");

t50[68]=GetSymbolField("2324.tw","close");

t50[69]=GetSymbolField("2633.tw","close");

t50[70]=GetSymbolField("2356.tw","close");

t50[71]=GetSymbolField("9904.tw","close");

t50[72]=GetSymbolField("8046.tw","close");

t50[73]=GetSymbolField("2492.tw","close");

t50[74]=GetSymbolField("6409.tw","close");

t50[75]=GetSymbolField("2354.tw","close");

t50[76]=GetSymbolField("2353.tw","close");

t50[77]=GetSymbolField("2834.tw","close");

t50[78]=GetSymbolField("2227.tw","close");

t50[79]=GetSymbolField("2347.tw","close");

t50[80]=GetSymbolField("9914.tw","close");

t50[81]=GetSymbolField("6239.tw","close");

t50[82]=GetSymbolField("3702.tw","close");

t50[83]=GetSymbolField("2360.tw","close");

t50[84]=GetSymbolField("3406.tw","close");

t50[85]=GetSymbolField("2385.tw","close");

t50[86]=GetSymbolField("9945.tw","close");

t50[87]=GetSymbolField("2337.tw","close");

t50[88]=GetSymbolField("3044.tw","close");

t50[89]=GetSymbolField("1504.tw","close");

t50[90]=GetSymbolField("1227.tw","close");

t50[91]=GetSymbolField("2313.tw","close");

t50[92]=GetSymbolField("2618.tw","close");

t50[93]=GetSymbolField("1605.tw","close");

t50[94]=GetSymbolField("2542.tw","close");

t50[95]=GetSymbolField("2344.tw","close");

t50[96]=GetSymbolField("1434.tw","close");

t50[97]=GetSymbolField("1229.tw","close");

t50[98]=GetSymbolField("2376.tw","close");

t50[99]=GetSymbolField("1722.tw","close");

t50[100]=GetSymbolField("2610.tw","close");

variable:count(0),i(0);

count=0;

for i=1 to 100 begin

if t50[i] > average(t50[i],22)

then count=count+1;

end;

plot1(average(count,3)-50);

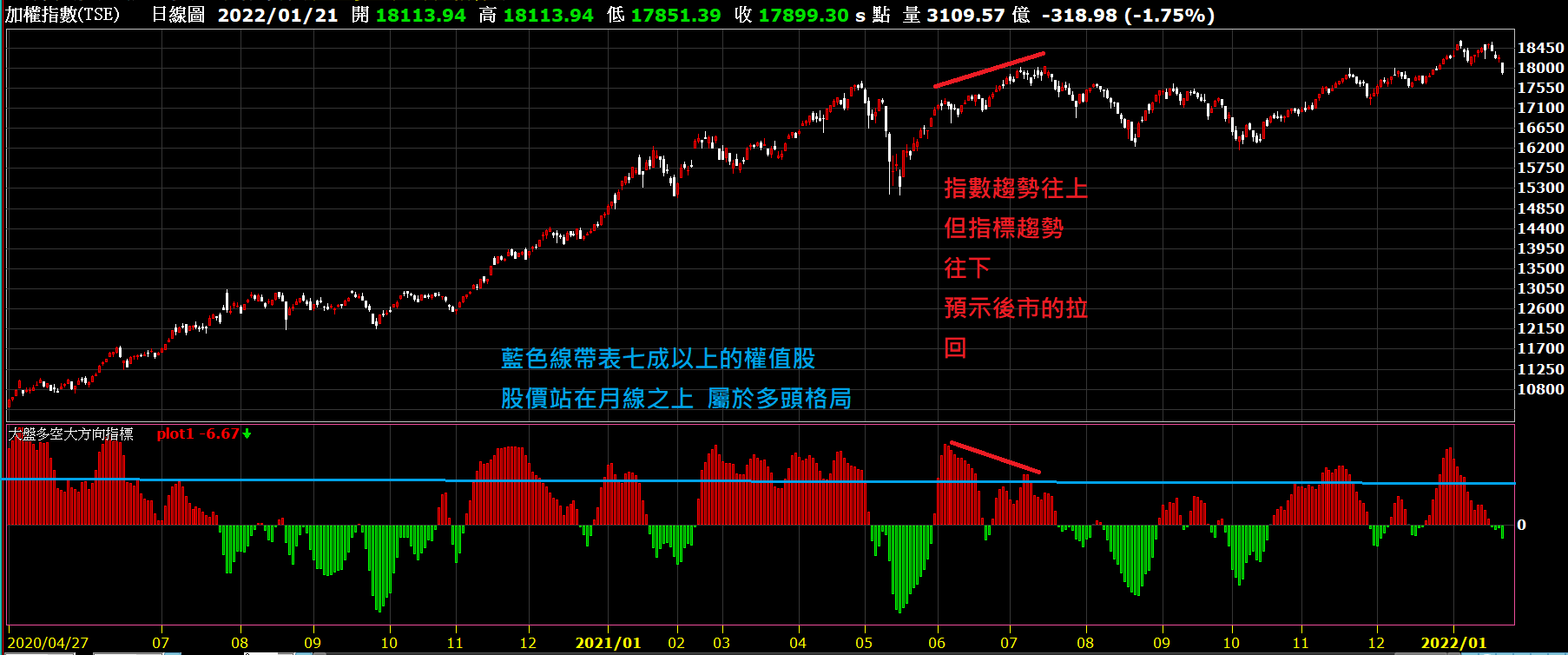

用這個指標畫出來的圖如附圖:

大家從附圖中的說明來研判目前大盤是屬於多頭架構還是空頭架構。

其次是在空頭架構中,反彈時,站上月線的個股數不多,但如果是回升,站上月線的個股數會非常快速的持續增加。

要特別跟大家說明的是,上面的腳本是我先前寫的,目的只是跟大家報告可以透過這樣的方式來設計指標,這兩年成份股一直有在變,有的股票也下市了,請大家務必要自己再根據現況再調一下。