市場老手常說量比價先行,量比價重要,那麼是不是所有股票只要出量了都能追? 倒也不必然。那什麼股票出量可以追呢? 我的經驗是基本面及估值面都不錯的個股,出量去追時,贏多輸少的機會比較大。

首先跟大家分享我用來挑選出量股的腳本:

value1=GetField("佔大盤成交量比","D");

setbackbar(20);

input:length(20);

variable:up1(0);

up1 = bollingerband(value1, Length, 2 );

if

value1 crosses over up1

and close>close[1]

//量暴增而且股價上漲

and close<close[1]*1.08

//但漲幅沒有非常大

then ret=1;

我用的不是單純的成交量,而是佔大盤成交量比這個值,我是去算這個數值的BB值,當BB值突破上緣,且單日雖上漲,但漲幅小於8%時,就符合我的條件。

單純拿這個腳本去回測,勝率是55%,報酬率輸大盤,顯示光出量就去買不是個好策略。

但我如果專門去尋找那些獲利能力在好轉,營收近期表現不錯,且估值不算貴的股票,回測的結果就蠻好的。

關於獲利能力好轉,我用的是以下的腳本:

if barfreq<>"Q" then raiseruntimeerror("頻率請用季");

//value1=GetFieldDate("營業利益率","Q");

if netprofitrsi cross over 50

//and value1=20180301

then ret=1;

outputfield(1,netprofitrsi,1,"營業淨利率RSI");

outputfield(2,value1,0,"最新資料日期");

這裡用到一個函數: netprofitrsi ,腳本如下:

value1=GetField("營業利益率","Q");

value2=highest(value1,8)-lowest(value1,8);

value3=value1-lowest(value1,8);

if value2<>0 then value4=value3/value2*100;

ret=value4;

這是去計算過去八季的營業利益率的RSI,RSI破50,代表獲利能力在好轉中。

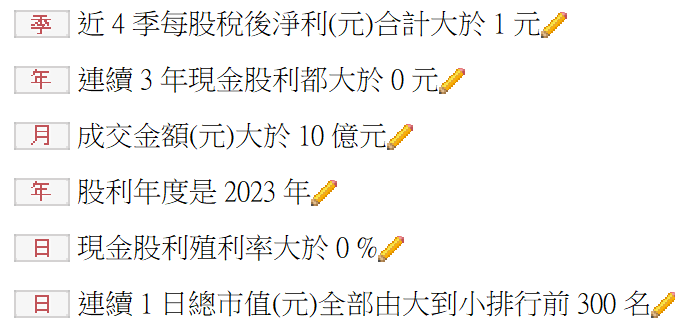

除了這個條件之外,另外我加了幾個條件:

一、過去三個月營收年增率都大於5%

二、營業利益率大於5%

三、股價淨值比小於1.8倍

四、收盤價小於150元

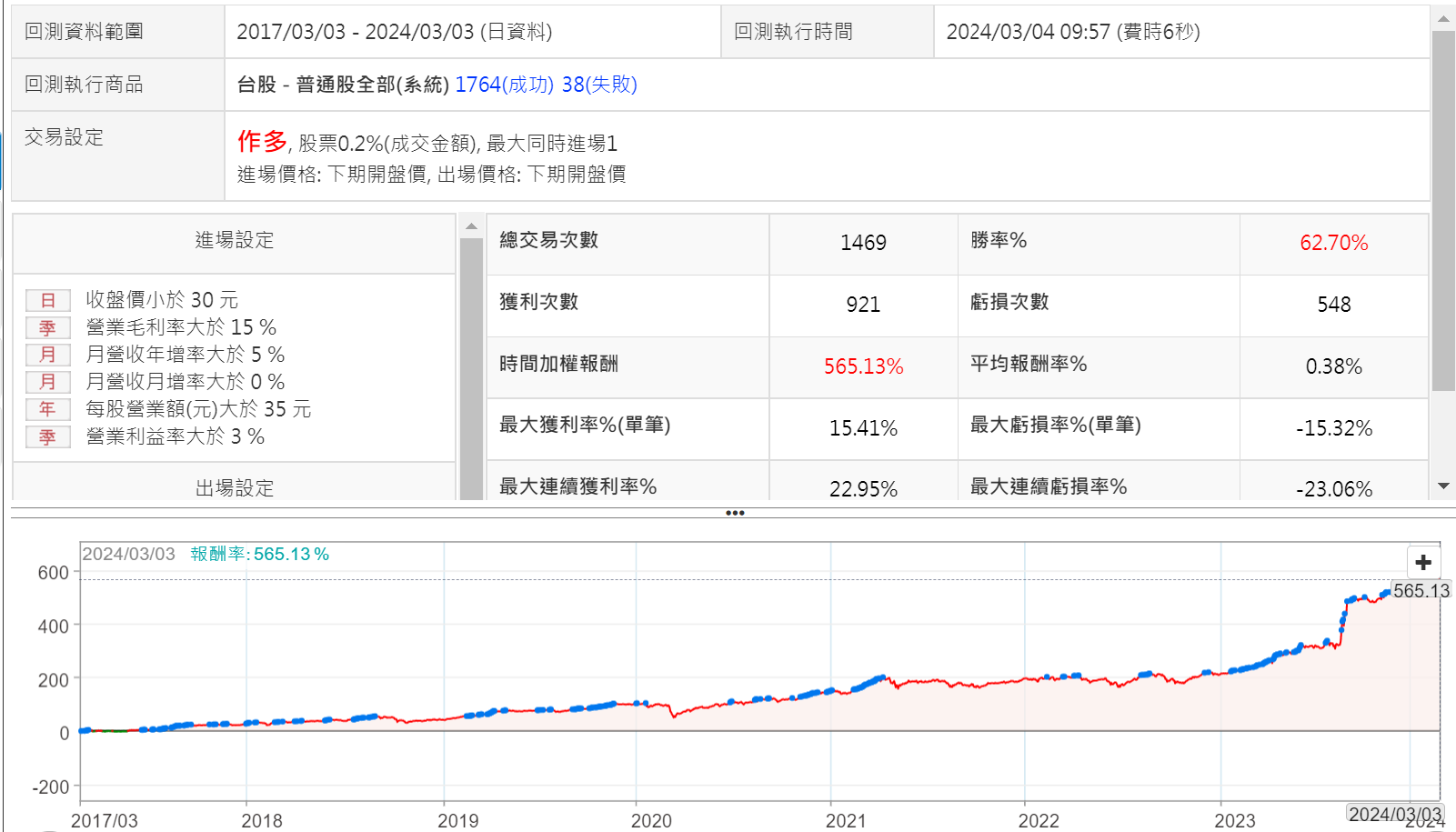

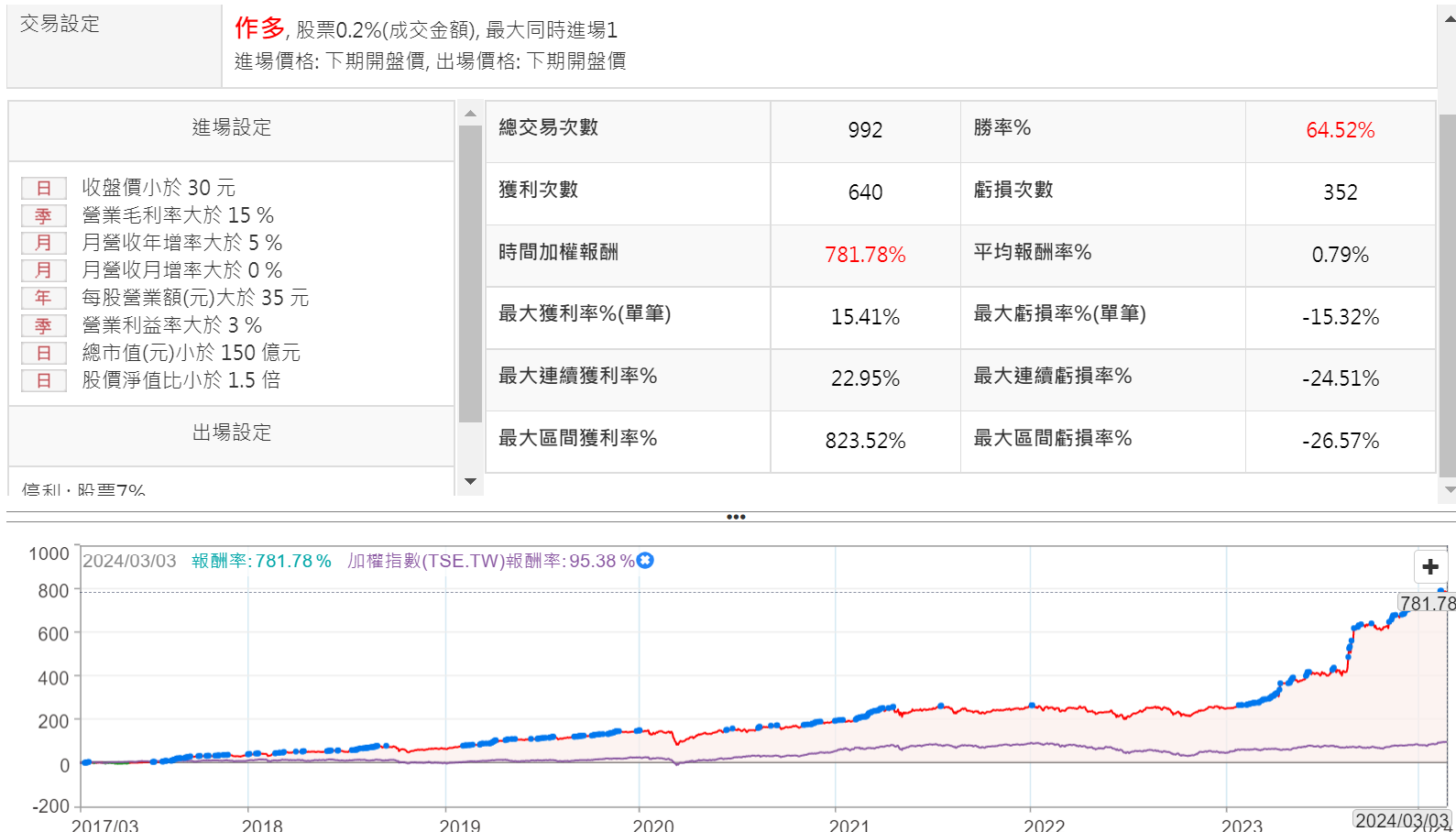

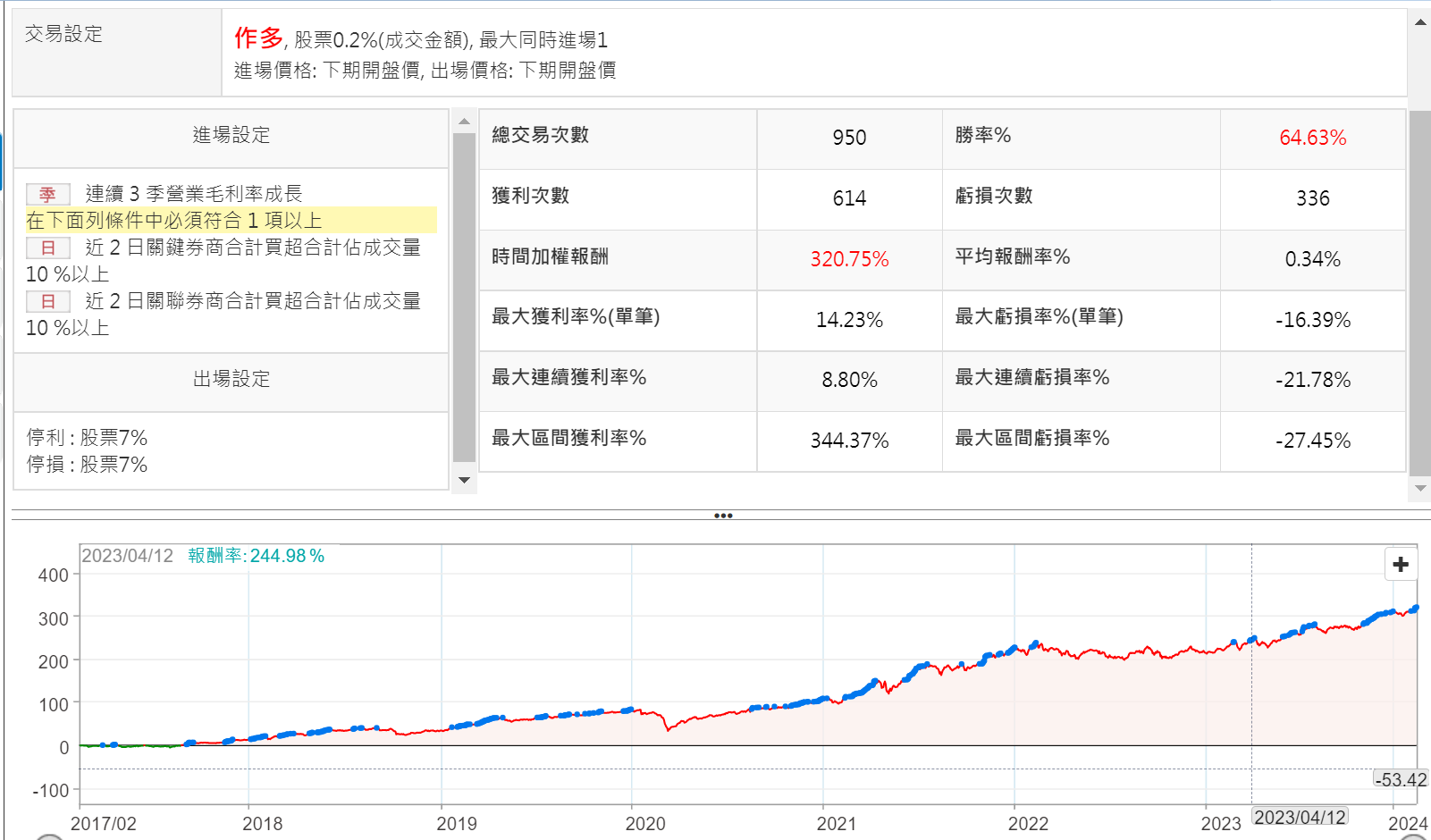

下圖是綜合上述條件,回測所有普通股,停損停利都設為7%的回測報告:

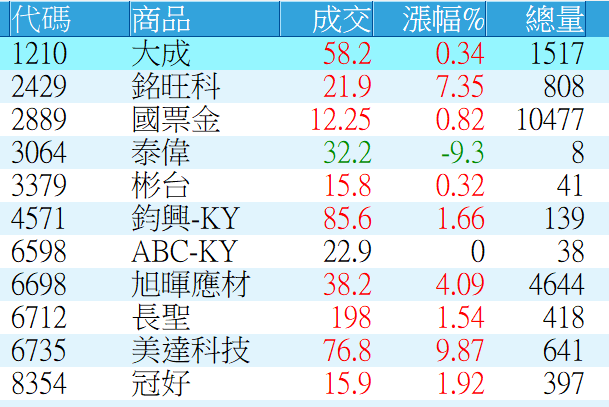

這個策略的總報酬,MDD都符合可實戰的標準,所以挑出量的股票,建議挑基本面回升且估值在合理範圍內的個股。

===

● XQ【盤後量化選股模組】($1,000) 完整介紹 ➤https://xqcom.pse.is/5nl3wk

● 首次訂閱享7天鑑賞期,首次購買輸入官方優惠碼「@XQ8899」,可折抵模組費用$100!

● 量化交易超值方案!購買就送:【量化積木+台股進階】(總價值$800)